Tax Assistance

Senior Tax Relief Work Program

A program designed to provide property tax relief to Marshfield residents 60 years and older living on a fixed income by allowing them to use their skills to assist the various town and school departments. In 2025, seniors may earn up to $1500 per year that is then applied as a tax credit to the 3rd & 4th quarter tax bills. Residents must reside in the property for which tax relief is being requested. Applicants must apply yearly. Applications are available beginning every January at the Senior Center. This program is funded by the Town of Marshfield and administered by the Marshfield Council on Aging.

Free Income Tax Preparation

The Marshfield Council on Aging in conjunction with the AARP Foundation and the Internal Revenue Service provides free, confidential income tax return assistance for low to moderate income taxpayers of all ages, with special attention to those 60 years and older. AARP Foundation Tax-Aide volunteers are trained, certifice and experienced with basic, non-complex federal and state tax returns. This service is available annually from February to mid-April. To make an appointment, contact 781-566-0626. Intake/interview booklets are available at the Senior Center.

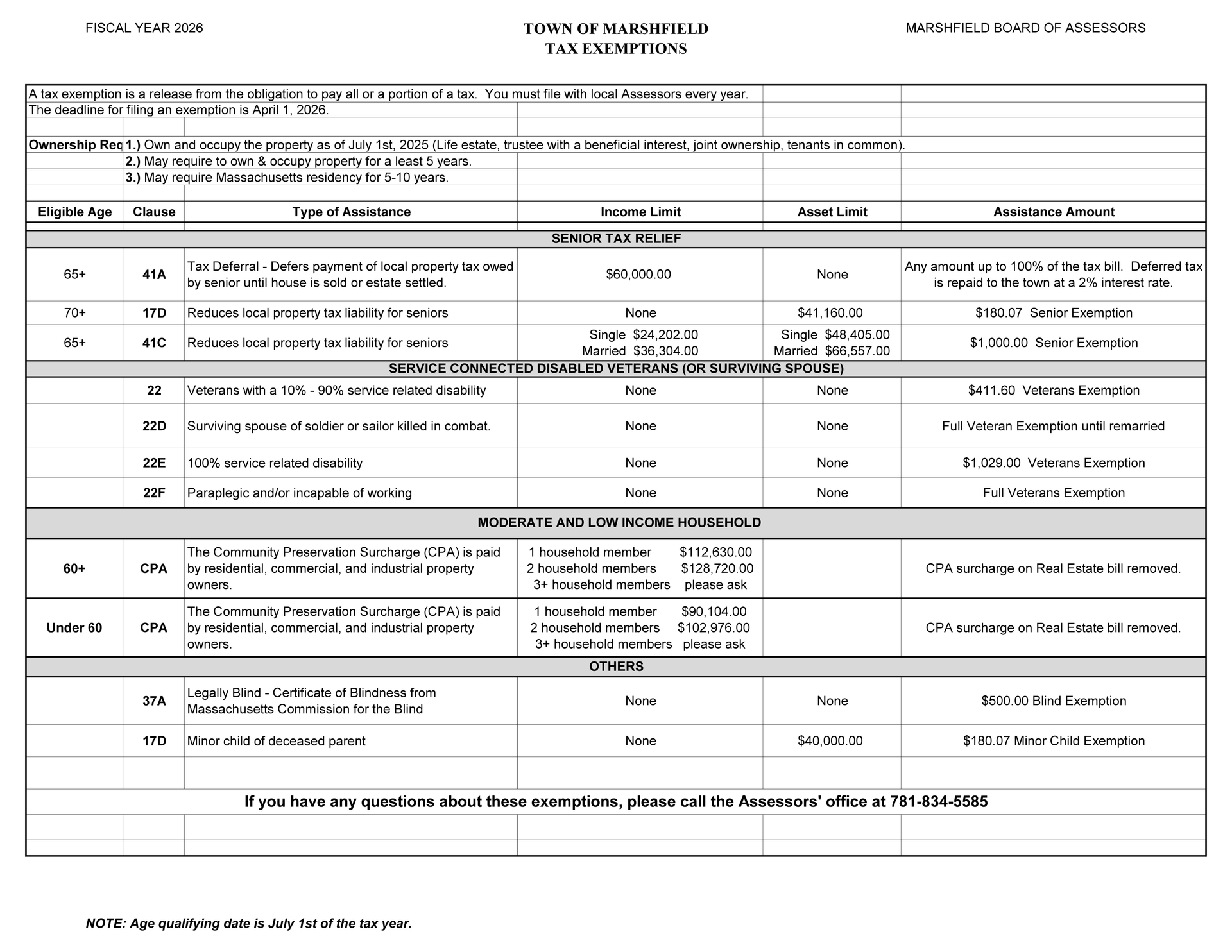

Elderly Tax Exemptions for Marshfield residents